They are there to help you when life takes you up. They can help you regardless of your lack of credibility or if leading credit professionals have ignored you through MyFortiva.

Their long-standing involvement and innovative innovations let them choose agile options, and their wide range of currencies enables you to pick the one that’s right for you.

The bank of Missouri issues My Fortiva credit card. Those with low credit scores can apply for it. If you qualify, you could build or rebuild your credit score. However, the fees and APR are high, and you can only request a card if you have received an invitation in the mail.

Without leaving a security deposit, you can get the fortiva credit card when you have funds and wish to access an unsecured credit line. By using it responsibly, you’ll improve your credit score and build good credit, as My Fortiva reports to each of the three major credit bureaus. This page has all the details you need about My Fortiva account. You should carefully read through all of the information on this page.

Steps for MyFortiva Credit Card Login

Fortiva credit card users can log in online and manage their Fortiva accounts. Once you’ve signed up through the Fortiva credit card login app, you can access your My Fortiva payments, apply for a new loan, and more. A person does not have to visit the agency personally to take advantage of all its services.

- You must first register at www.myfortiva.com.

- Click the fortiva credit card registration tab on the right side of the home page and have MyFortiva activate.

- Enter your username and password.

- Click on My Fortiva ID and wait for it to open.

As soon as your fortiva account is created, you can set it up online and get your fortiva credit card if you haven’t already.

How to Apply for MyFortiva Credit Card?

If you want MyFortiva activated, apply online, don’t go anywhere, and apply on the official website. After a few steps, you can fill out an application form. Take a look at the steps here:

- First, visit www.myfortiva.com and click on a fortiva credit card. Apply online

- Click the “Reply to a quote by email” link to respond to a quote by email.

- Enter the acceptance code in the field provided. You will find your code at the end of your postal offer.

- Click “Submit Code” and follow the instructions to complete your Fortiva credit card form.

You must confirm your personal information. You must also declare your annual income.

How to Activate your Fortiva Credit Card?

The fortiva credit card can be activated at the fortiva account center, and the process is relatively straightforward. You will find the activate option in the upper right corner of the page of fortiva credit card login once you have logged into MyFortiva’s official website. Upon registering or logging in, the user will have two options for activating the card.

People who already have a MyFortiva credit card account can log in by entering their username and password and clicking on the fortiva login option. The MyFortiva Credit Card has been successfully activated.

Perks Of Fortiva Credit Card Login

- Report fraud quickly through www.myfortiva.com customer service

- Benefit from quick access to auto and home loans

- Transfer money and deposit a check

- Repay your car and a home loan from your home.

- View and report statements through fortiva card

- Use your cell phone when sending money to protect your fortiva card account.

Here are some of the perks of registration bonus:

- No annual maintenance fee from $60 to $159 after the first year (charged from $5.00 to $12.50 per month) on fortiva credit card login

- Up to $38 for late payments

- Up to $38 for refunds

- One-time fee for authorized users of $25

- One-time $25 program fee when opening an account

- Cash advance fee of $5 or 5%, whichever is greater

- 3% balance transfer fee

- 3% foreign transaction fees

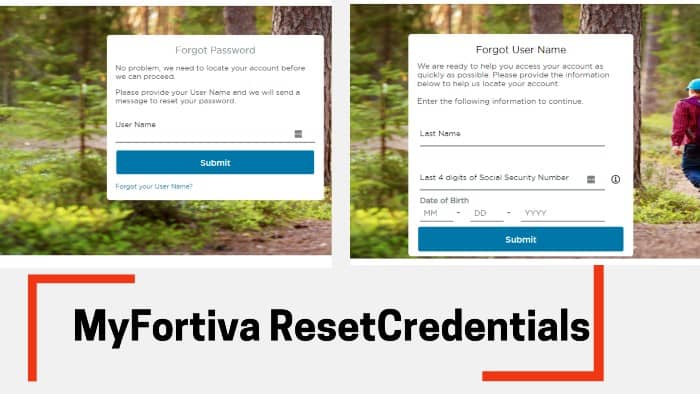

What is My Fortiva Login Credentials Retrieving Process?

Step-by-step instructions for resetting your Fortiva credit card account password:

- The first step is to visit www.myfortiva.com, click on the “Sign up” button, and enter only your email address or username in the space provided.

- If you enter your My Fortiva login details, please use an alternate email address provided by fortiva as an alternate contact option when registering for the Service.

- Then, go to www.myfortivacreditcard.com/forgopw and enter your customer ID (usually found at the bottom of your bank statement), your birth details, your last four social security numbers, and your email address. Register with My Fortiva credit card login account.

- Last but not least, click “Send,” answer your security questions, and verify your identity. We will send you an email or SMS containing your password.

You can now log in to fortiva card login using your new login information!

Fortiva Credit Card Benefits

Report your payment history to the credit bureau: As long as you keep paying your bills on time each month, this MyFortiva card login can help boost your credit. Monthly report to very large credit bureaus.

Easily Linked Credit Cards for Bad Credit: People with bad credit are severely limited in the credit cards they can and cannot get. In most cases, you are tied down to a secured credit card, which is highly restrictive. You aren’t tied to a secured card with MyFortiva MasterCard.

EMV Chip: This credit card protects your identity. Identity protection is believed to be a challenge in today’s digital world. However, the MyFortiva card login is used to prevent fraud and identity theft. It comes with an EMV chip built into the card. Using this card provides a higher level of security.

Lower Normalized Payments: The Fortiva credit card has very low monthly recognized payments. You pay only 1% of your $10 balance and deliver the biggest must.

Free access to credit: Another incredible benefit is access to your credit. You can’t get your credit score correct if you’re unsure what’s wrong. In that case, the MyFortiva credit card will give you access to your credibility. You can monitor it monthly to see how your fortiva credit card payment login history is accumulating.

No Security Deposit Required: I think you need a security deposit to open this card because a credit rating is terrible. However, it is not necessary, and pea is an unsecured card.

$0 Fraud Liability: Did someone get their hands on your retail MyFortiva credit card and make some unauthorized purchases? The fraud will not be liable if it is reported within 24 hours.

Wide acceptance of MyFortiva MasterCard: The fortiva credit card is a MasterCard, despite its low level of expertise. Mastercard is the world’s most widely accepted credit card.

How to Pay Fortiva Credit Card?

Paying with a myfortiva credit card involves creating an account on My Fortiva login to make other paid payments. See how you control your card and have all transactions at hand. Another efficient way to use myfortiva.com as a client is through a new fortiva credit card account.

- MyFortiva Login for payment can be made over the phone, online, or by mail.

- To make payments using the fortiva app, account holders must first download the app from the app store and fortiva account center, sign in, and follow the instructions to complete the payment process at myfortiva.com.

- Users can also activate by paying online at fortiva credit card payment login. To do this, you must first visit the Fortiva home page, then find a Manage My Account option by entering your username and password to complete the Fortiva login process.

- The following process is to select a payment invoice, enter the amount to be paid and cancel your invoices.

- Logging into your Fortiva credit card account is the only way to make a Fortiva credit card payment. According to Fortiva, users must have a password and ID when accessing its online system.

| Official Name | MyFortiva |

|---|---|

| Portal Type | Login |

| Services Provided | Credit Card Payment & Info |

| Mobile App | Not Available |

| Country | USA |

Fortiva Retail Credit Cost

As part of our business development process, our team will assess your business needs, develop a plan and a pricing structure that meets your needs. We will maximize the number of licenses and minimize business costs with this program.

Credit Card Travel Notification

The easiest way to post a travel notice is to call the number on the back of your Fortiva credit card. Alternatively, you can send your bank a secure message through its online portal.

However, if you don’t want to wait for customer service or you’re traveling for the next few days and can’t wait to get a message, you may have other options, and depending on the issuer, you may not even need to create a notification.

Frequently Asked Questions

What is my Fortiva credit card?

Fortiva MasterCard is a secured credit card for those with little or no credibility. This means that you can basically have a credit card, even with a terribly low credit score. However, we recommend that you use this credit card only to determine your creditworthiness.

Where can I use My Fortiva credit card?

As mentioned at My Fortiva login site, this is a MasterCard. That means you can use a Fortiva credit card anywhere.

MyFortiva Credit Card Apply Online

Before applying for this credit card, you must receive an invitation letter from the MyFortiva credit card login page. Once you receive this letter, you can apply for a MyFortiva MasterCard. In this page’s “Ordering” section, you can find out how to place an order or can directly go to My Fortiva account.

Are there other fees?

There is a monthly maintenance fee of $12.50 per month. There is also a program fee when you open a fortiva credit card.

What are the charges and fees on MyFortiva.com?

- Annual fee: $49 to $175 for the first year and from $0 to $49 per year thereafter

- APR: Purchases: 21.99% to 36% depending on solvency

- Cash advances: 24.99% to 36%

- Balance transfers: 24.99% to 36%

Last Note

The fortiva credit card has a lovely card, and the site is very easy to use. It was good that they also had a comprehensive FAQ section for customer service. The only downside I’ve found with the MyFortiva credit card login so far is that you need a big loan to apply. They didn’t have “pre-approval” or anything like that on the site. However, if your credit score is not perfect but still good enough (at least 680 FICO points), this company can help! They offer a few different cards, something for everyone, whatever your situation.

Fortiva is a famous banking institution in the United States. Their website enables credit card users to apply for credit cards online. From there, Fortiva credit card users can log in and manage their My Fortiva account online. Once you’ve signed up through the Fortiva app, you can collect your Fortiva payment, apply for a new loan, and more from home. Services offered at the agency can be accessed without visiting the office in person.